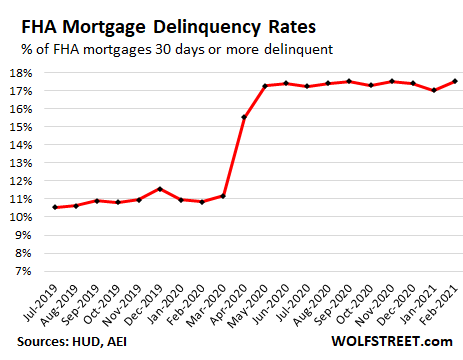

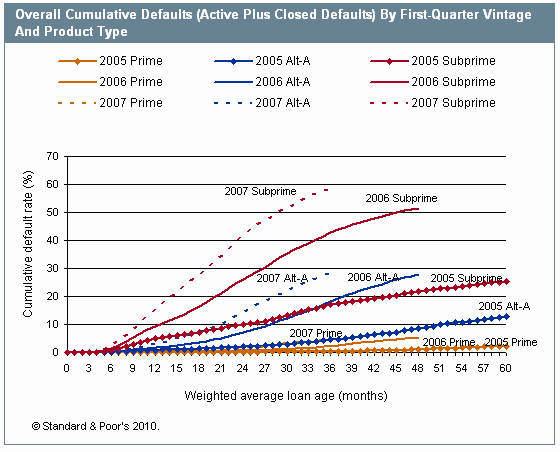

The next edition will be published here on 12 December 2023. See our previous editions of the statistics on mortgage lending. proportion of mortgage loans above Bank Rate More importantly, unmarried borrowers living with furnished tenancy agreements who have relatively new jobs have a probability of defaulting of more than 60.total gross advances by loan-to-value, income multiples and purpose of loan.the outstanding value of all residential loans.The FCA and the Prudential Regulatory Authority (PRA) both have responsibility for the regulation of mortgage lenders and administrators so this data publication is joint. Since the beginning of 2007, around 340 regulated mortgage lenders and administrators have been required to submit a Mortgage Lending and Administration Return (MLAR) each quarter, providing data on their mortgage lending activities. This was the first increase and highest value observed since 2022 Q3. The value of new mortgage commitments (lending agreed to be advanced in the coming months) in 2023 Q2 was 26.2% greater than the previous quarter but 26.6% less than a year earlier, at £61.7 billion.This was the lowest observed since 2020 Q2. economic and socio-demographic characteristics and takes into account the. The value of gross mortgage advances in 2023 Q2 was £52.4 billion, which was £6.3 billion lower than the previous quarter, and 32.8% lower than in 2022 Q2. probability of default on loans is of great importance to monitor the outlook.The outstanding value of all residential mortgage loans was £1,655.5 billion at the end of 2023 Q2, 0.4% higher than a year earlier, but the largest decrease on the previous quarter since reporting began in 2007.MLAR statistics: detailed tables (Excel)įor any technical queries on the tables contact MLAR Statistics.Īn explanatory note detailing the relationship between this data and other mortgage statistics published by the Bank of England is available on their website.It accounts for 4.9 of non-housing consumer debt. Personal loan debt makes up 1.4 of outstanding consumer debt in the second quarter of 2023. MLAR statistics: summary tables (Excel) 22.7 million Americans have a personal loan as of the second quarter of 2023, up from 21.0 million a year earlier.guarantees the mortgage and insures the lender in the event the borrower defaults on their loan. The commentary includes technical information on the MLAR as well as analysis of the findings. Subprime mortgages, on the other hand, often stretch the repayment term to 40 or even 50 years.

Subprime mortgage defaults by demographics full#

The latest commentary and full statistical tables are available below. After controlling for neighborhood demographics and economic conditions, the authors find that subprime loans lead to foreclosures at far greater rates than. Statistics on mortgage lending: Q2 2023 edition

0 kommentar(er)

0 kommentar(er)